TL;DR

December belongs to the algorithmic biographers. Wrapped season is upon us.

Here are five predictions for 2026. I'll score myself honestly next December.

It’s my last newsletter of 2025! Thanks for reading. See you in January.

Hey you. Merry Christmas, if you’re into that sort of stuff.

This week I’m writing to you from my flight to Sydney, Australia. Fourteen hours with no Wi-Fi!! I am rarely this disconnected. It hurts.

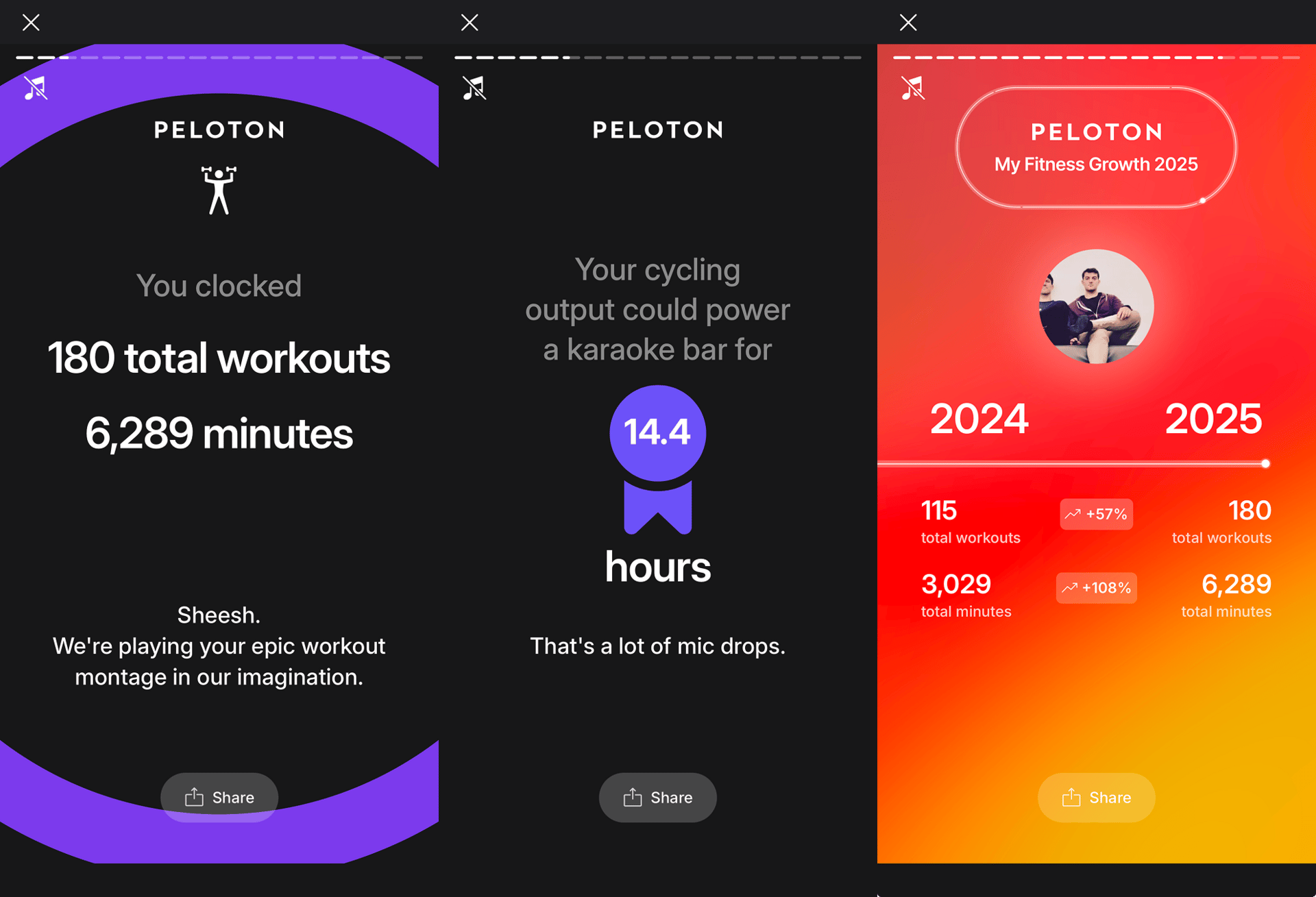

It's the final week of December, which means my inbox is full of "Wrapped" recaps. Spotify told me I'm in the top 0.5% of Fetty Wap listeners. Peloton let me know I spent 6,289 minutes on the bike. The New York Times lauded me for finding the Spelling Bee pangram 53 times.

In case you doubted my commitment to cardio… I brought the receipts 🚴

The algorithms have become our biographers now. They summarize our years before we've had time to process them ourselves. I find there is something comforting about the ritual. A year of scattered effort and half-finished initiatives get compressed into a pretty carousel. A neat bow on 365 days.

But the summary is always incomplete. Spotify knows I played Fetty’s 2025 breakout single "Again" on repeat during a particularly grueling few weeks in February. It doesn't know why. The apps capture the behavior, but at least the meaning remains mine to assign.

On Predictions

Every December, alongside the retros, comes prediction season. Analysts and pundits publish their forecasts. Most are hedged into uselessness:

"Markets will experience volatility." … "Geopolitical tensions will persist." … “Technology will continue to evolve."

Nobody likes to be proven wrong.

A few years ago I read Superforecasting by Philip Tetlock. The book studied thousands of people making predictions about geopolitics, economics, and world events. The best forecasters were more calibrated than they were smart or credentialed. They updated their beliefs when new information arrived. They thought in probabilities rather than certainties and they kept score on themselves, ruthlessly.

The worst forecasters were the confident ones. The pundits who spoke in absolutes. The experts who never revised their models. Tetlock called them "hedgehogs" because they knew one big thing and applied it to everything. The best forecasters were "foxes" who knew many small things and synthesized accordingly.

The insight from Superforecasting that stuck with me: prediction develops your relationship with uncertainty. You make a claim, assign a probability, watch what happens, and learn. The muscle only grows if you're willing to be wrong in public.

My friend Max has been running a yearly predictions survey for our friend group the past few years. Every January, we submit our forecasts. Every December, he scores us. It's humbling.

This year, I'm putting five of mine in writing. They are concrete, testable, and falsifiable. By this time next year, I'll either have built credibility or learned humility. Probably both.

1. AI Hits a Physical Wall

The most contrarian thing I can say about AI in 2026 is also the most boring: electricity.

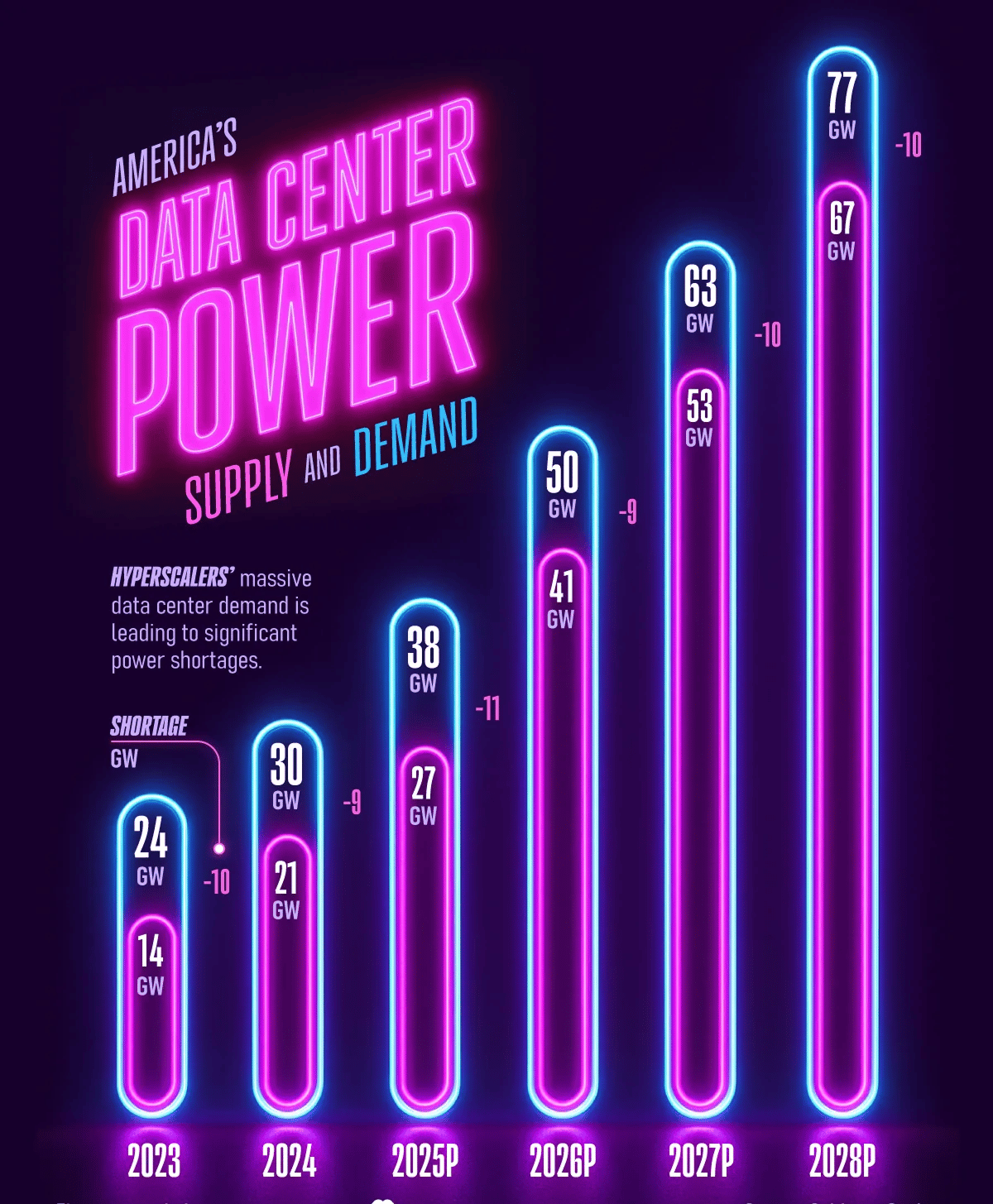

By 2026, US data center power demand is projected to reach 49.8 gigawatts. Supply will hit 40.5 GW. That's a 9.3 gigawatt shortfall. Put into perspective, that would require the power of nine nuclear reactors that simply don’t exist.

The deficit gets worse when you zoom in. Starting in 2026, each AI hyperscale facility (the massive data centers being built by Google, Amazon, etc.) will draw at least 1 GW each. For context, total US data center demand was only 4 GW in 2024. The grid is being asked to absorb a 30x increase in load.

Northern Virginia, the world's data center capital, is already saturated. Ireland, where data centers consume 32% of national electricity, implemented a moratorium on new builds in Dublin in 2022. They lifted it this year. Demand won.

My prediction: By end of 2026, at least three US states or major metro areas will have imposed moratoriums or severe restrictions on new data center construction. The laws of thermodynamics will throttle AI growth before chip supply or model capability does.

Confidence level: 75%

For now, we can’t prompt-engineer our way around physics.

2. Markets Keep Climbing

This one will annoy the recession predictors who have been largely wrong for the past decade.

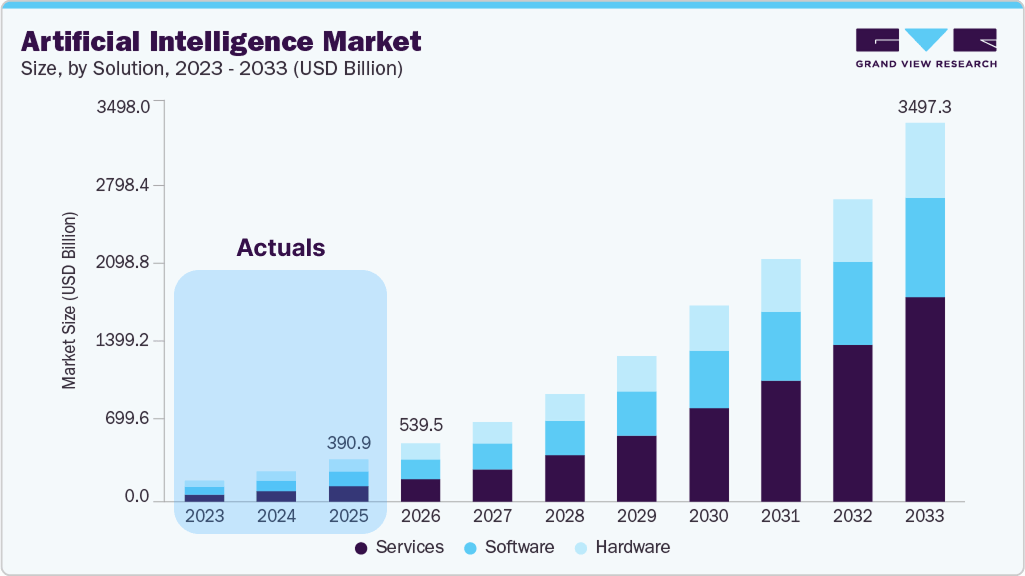

Despite the AI power constraints I just described, I expect markets to finish 2026 higher than they started. The S&P 500 ends the year up at least 10%. I expect we will see the first $5 trillion company (likely Nvidia or Microsoft) by late 2026.

Financial narratives and physical realities operate on different timescales. Markets price in future expectations. The AI story is too compelling, the capital flows too strong, and the alternatives too unattractive for a sustained correction. Sure, the constraints are real and a reckoning is coming (it always is). But I don't think 2026 is the year—especially with a Trump-loyalist expected to take the helm at The Fed.

Say what you want about AI, but the actuals don’t lie. People and businesses pay for these tools and are expected to spend aggressively in 2026 and beyond. Via Grandview.

The economy has absorbed higher interest rates, persistent inflation, and geopolitical chaos. And yet, consumer spending remains resilient and the labor market refuses to crack. Everyone has been waiting for the shoe to drop, but it seems the shoe is glued to the ceiling.

The prediction: No US recession in 2026. S&P 500 finishes the year up double digits. At least one company crosses the $5 trillion market cap threshold.

Confidence level: 60%

I reserve the right to feel conflicted about being right if this happens.

3. GLP-1s: Pills, Pets, and Paywalls

I've been on tirzepatide since 2021, before the Kardashians had heard of Ozempic. The shot changed my relationship with food. For the first time in my adult life, I wasn't half-thinking about what’s in the fridge.

In 2026, that experience will become simultaneously more accessible and less accessible. Classic American bifurcation.

The "more accessible" part: oral GLP-1s hit the market in pill form. No more weekly injections. Adoption accelerates. And in a recent development I genuinely did not see coming, GLP-1s for pets will go mainstream. We overfed our dogs the same way we overfed ourselves. Now we're medicating them into thinness too.

4: OKAVA Pharmaceuticals is running a trial called MEOW-1 for overweight cats. An ultra-long-acting GLP-1 implant. For cats. Via OKAVA.

The "less accessible" part: insurers revolt. At $1,000+ per month per patient, widespread coverage would bankrupt employer health plans. Mass General Brigham has already announced it will end weight-loss coverage for employees in 2026. Others will follow. GLP-1s for weight loss become a luxury good, an out-of-pocket expense for the professional class. Meanwhile, Medicare launches a program expanding access for seniors.

The prediction: By end of 2026, the majority of large employer health plans will have dropped GLP-1 coverage for weight loss (diabetes coverage remains). At least one major pet pharmaceutical company will have a GLP-1 product on the market.

Confidence level: 55%

Government-subsidized thinness for retirees. Cash-only for the working-age population. Your obese mutt gets coverage before you do.

4. Space Becomes the Breakout Sector

While everyone obsesses over AI, the actual next frontier is becoming commercially viable.

Launch costs have dropped 90% in fifteen years. SpaceX now handles 84% of US launches. Starship is targeting in-space propellant transfer tests in 2026, the technology that makes deep space operations possible. The Rivada satellite constellation is scheduled to launch in June.

If Starship achieves its milestones, cost-to-orbit drops another order of magnitude. That enables things that were previously science fiction: heavy industrial infrastructure in space, orbital manufacturing, even data centers that bypass earthbound power constraints.

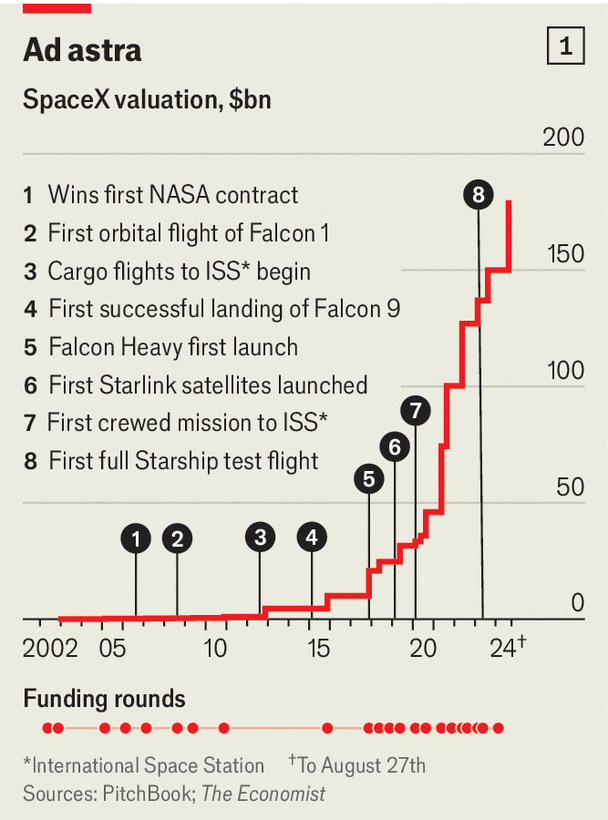

SpaceX valuation, 2002–2024, speaks for itself. Via The Economist.

The investment thesis is straightforward. AI is compute-limited by power. Power is geography-limited by grids and NIMBYism. Space has no grid constraints and no neighbors to complain. The escape hatch from terrestrial infrastructure limits is altitude.

The prediction: Space-related companies see a surge in private investment in 2026, with total venture funding in the sector exceeding $15 billion (up from roughly $8 billion in 2024). SpaceX files for IPO.

Confidence level: 70%

The biggest returns of the next decade might come from looking up.

5. Gambling Becomes a Public Health Crisis

Half of young men in America already have a sports betting account.

We legalized sports betting state by state, told ourselves it was harmless entertainment, and integrated it into every sports broadcast in the country. Every NFL game is now a gambling commercial. Prediction markets that "democratized" election forecasting use the same infrastructure that now enable 22-year-olds to blow their rent money on NFL parlays.

Problem gambling is spiking and the numbers are grim. One in five gambling addicts have attempted suicide. The apps are engineered for addiction the same way social media was engineered for engagement. Frictionless deposits, complicated withdrawals, and push notifications when you haven't bet in a while.

I don't bet on sports, but I'd be lying if I said this isn't what options trading and prediction markets feel like. Dopamine is dopamine.

Scott Galloway’s new book, Notes on Being a Man, describes a generation of “lost men". They are disengaged from work and disconnected from relationships… but deeply engaged with point spreads and parlays. The same demographic experiencing record NEET rates (Not in Education, Employment, or Training) and declining labor force participation is the same demographic with the highest sports betting adoption.

The prediction: By end of 2026, problem gambling rates will have increased at least 30% from 2024 baseline levels. At least two states will pass emergency legislation restricting sports betting app features (deposit limits, mandatory cooling-off periods, advertising restrictions). The cultural conversation shifts from "fun side hustle" to "public health emergency."

Confidence level: 80%

We're going to look back at the 2020s sports betting boom the way we now look back at 1990s cigarette advertising.

Happy New Year

This is the last issue of Inbox Hero for 2025.

I started this newsletter because I wanted a fun creative outlet. Thirty-two weeks later, I'm not sure I've arrived anywhere, but writing weekly has changed how I think. About technology, about politics, about what kind of life I'm trying to build.

Thank you for reading, for forwarding issues to friends who might care, and occasionally telling me I'm wrong.

I'll be back in January with more predictions, more contradictions, and hopefully fewer fourteen-hour flights without Wi-Fi.

See you in 2026.

Up and to the right.