TL;DR

Wages grow 1.5% annually. The S&P returns 10%. That gap is why half of young Americans have given up on capitalism.

This week, every American child born through 2028 started receiving $1,000 in index funds at birth. It's the largest expansion of asset ownership since Social Security.

The program is called Trump Accounts. We can hate the name and take the win anyway.

The Treadmill and The Escalator

Since 1980, wages have grown roughly 1.5% per year. Over the same period, the S&P 500 returned about 10% annually. Two paths beginning together, drifting apart until they no longer resemble each other.

If you rely on wages, you are on a treadmill. If you own capital, you are on an escalator.

The top 1% now holds more wealth than the bottom 90% combined. This is not a morality tale about talent or grit. The mechanism is simpler: owners compound while earners spend. Economist Thomas Piketty built an entire academic career around proving what grandparents understood without math: capital outruns labor. It just does. Silently and predictably.

This week, the largest expansion of asset ownership since Social Security went live.

The Machine

When we talk about American power, people usually think aircraft carriers and tech monopolies. But underneath it all, our might is the result of our capital markets that compound wealth more efficiently than any system humanity has ever constructed.

America’s capital markets are the engine behind everything else. Competition and yes, greed, drive businesses to build, hire, and grow. Those businesses employ 160 million Americans. Those employees and businesses pay taxes. Those taxes fund roads, schools, defense, and every social program politicians argue about. The government doesn't create wealth. It taxes wealth our markets create.

You can’t beat Wall Street. Via A Wealth of Common Sense

This is why America is the wealthiest nation in human history. We built a machine that converts investment into growth at scale, and we let it run.

You do not have to believe this machine is fair. You do not have to think the distribution of its rewards is just or moral or defensible. You can observe that it concentrates wealth in ways that strain democracy and still recognize a stubborn fact: nothing in human history has generated more prosperity than American capital markets.

I am a capitalist. I have raised venture capital, hired people, fired people, and built a company that survives by competing. I respect the engine even when it rattles.

And clearly, capitalism is losing altitude.

The Problem with Capitalism

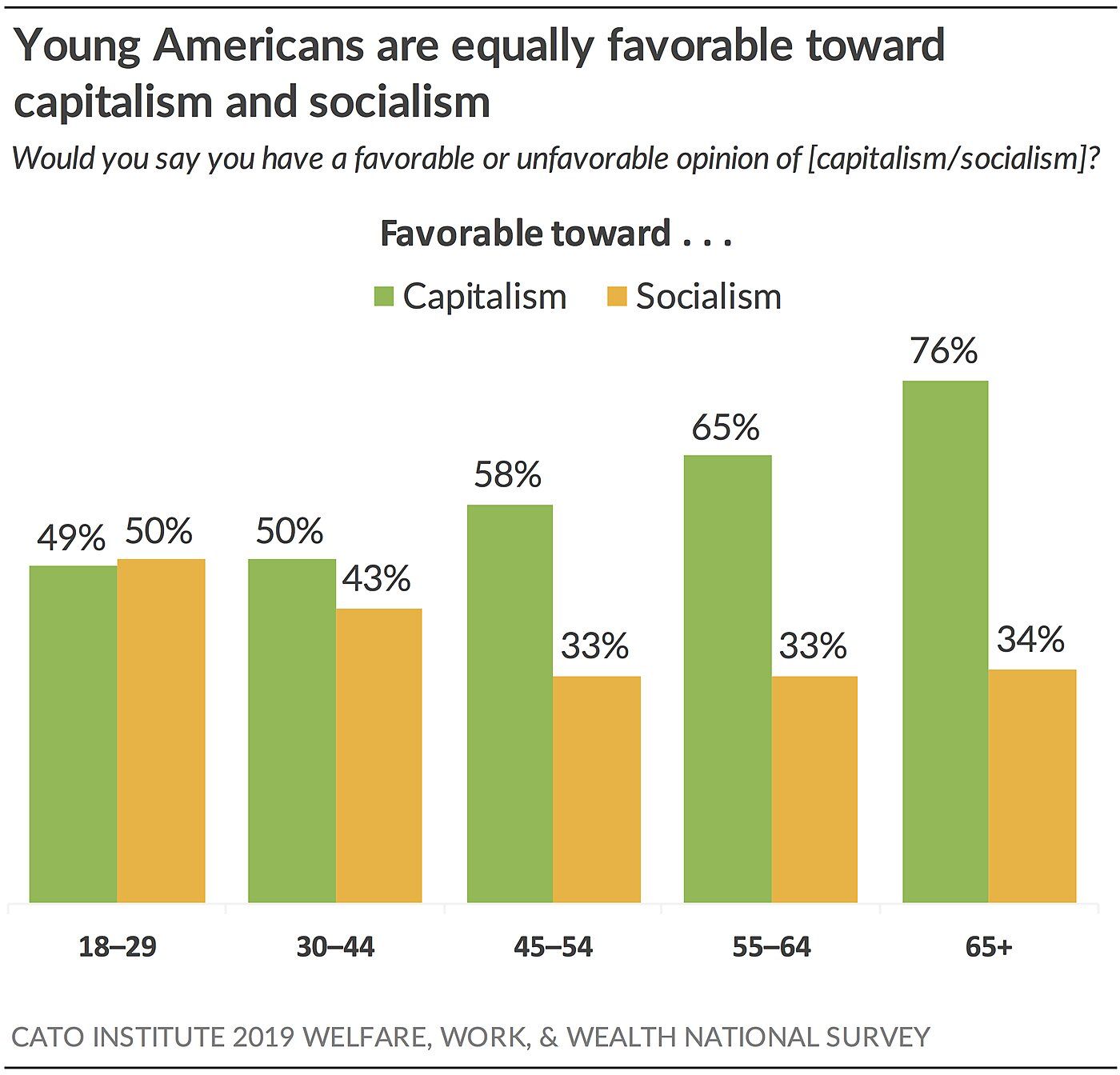

Less than half of Americans under forty say they believe in capitalism. The decline has been sharp. The frustration is rooted in lived experience. People who followed the script find themselves priced out of housing, juggling healthcare bills, watching debt accumulate, and seeing wealth concentrate far beyond their reach.

Every political movement of the past decade traces back to this legitimacy crisis. The Tea Party and Occupy Wall Street targeted different villains. The underlying wound was the same. Bernie Sanders and Donald Trump built movements from people who felt locked out of an economy that worked beautifully for those at the top. The rhetoric varied, but the resentment was identical.

America in a chart. Via Cato Institute.

History offers two paths for societies confronting extreme concentration of wealth. Redistribution or rupture. Peaceful restructuring or upheaval. Systems that ignore this pattern tend to discover the cost.

We are drifting toward a devastating outcome.

A Progressive Vision

Universal asset ownership has existed as a ghost idea in American policy circles for generations. Thomas Paine outlined a version. Milton Friedman reshaped it from the right. In 2023, Cory Booker advanced Baby Bonds: federally funded investment accounts for every child, with larger deposits for lower-income families.

If a lack of capital blocks mobility, then let’s provide capital at birth! Don’t just transfer income after the fact—rewire the starting conditions so more people participate.

Booker's bill went exactly nowhere. Democrats held the House, the Senate, and the White House, yet found a way to blow it anyway. Go figure!

So while progressives had the blueprint, they had no coalition.

Someone else did.

A New Policy

This week marks the national rollout of a program Congress approved earlier this year.

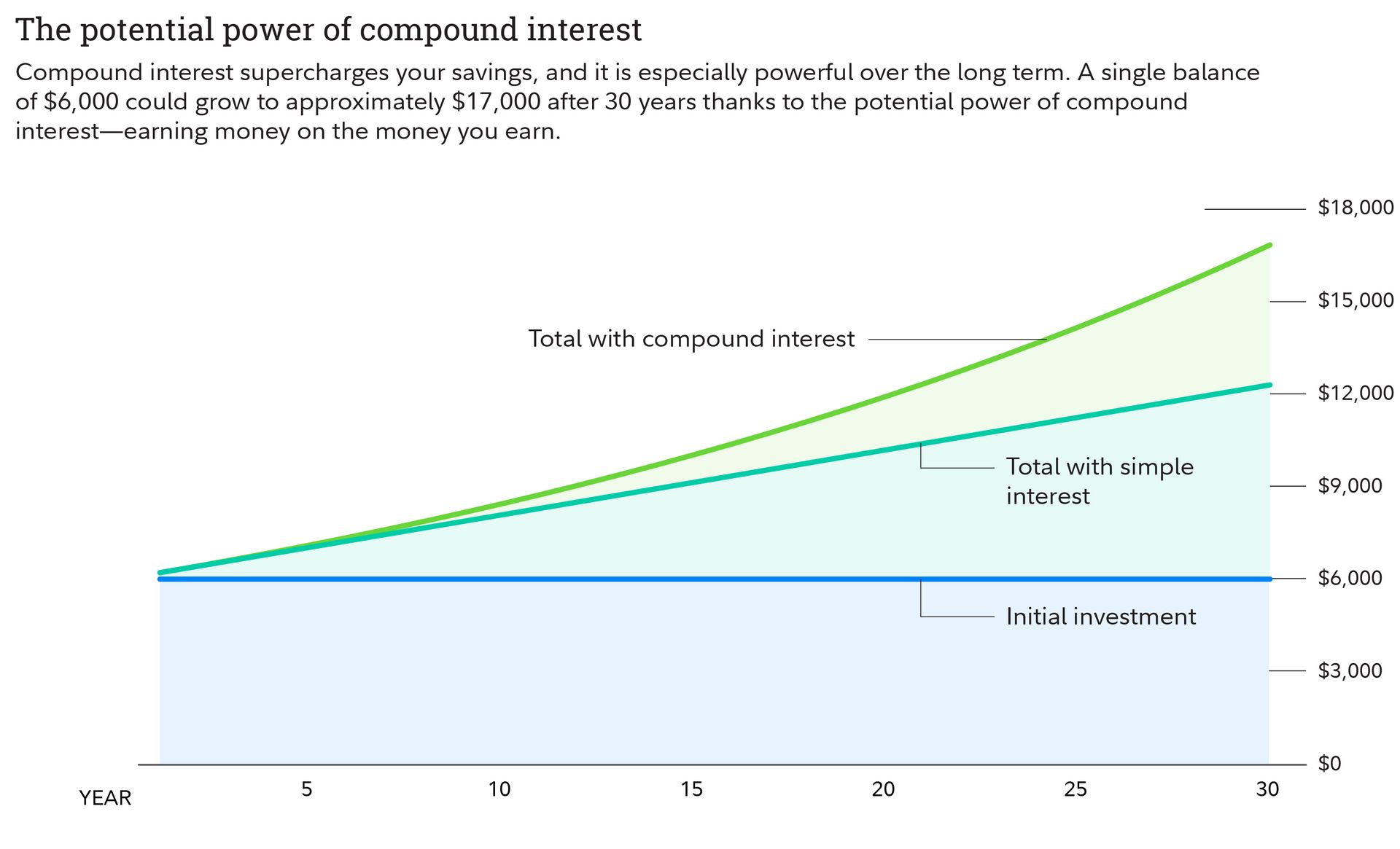

Every child born between 2025 and 2028 will receive a $1,000 federal deposit into a tax-advantaged account. The funds go directly into low-cost index funds that mirror broad sections of the U.S. stock market. Families can contribute up to $5,000 annually. Employers can add another $2,500 tax-free. Gains accumulate without annual taxation. Withdrawals in adulthood are taxed at long-term capital gains rates.

Don’t even care that Einstein never said it… compound interest really is the 8th wonder of the world! Via Fidelity.

The choice to mandate index funds with a strict fee cap is quietly transformative. It pushes government-sponsored accounts into the same strategy professionals trust for long-arc portfolios. No actively managed funds bleeding returns through fees. No salespeople steering unsophisticated families toward bad products. Just diversified exposure to American capitalism with minimal drag.

The accounts unlock at eighteen and can support education, a first home, or a business. Remaining balances continue to grow under standard retirement rules.

By 2028, sixty million children will have accounts. For most of them, this will be the first financial asset with the potential to shape their future.

Trump Accounts

The law calls these new vehicles Trump Accounts.

I can sense your disdain. I’m sorry.

But consider: if this policy had passed under Biden with identical mechanics but labeled American Dream Accounts, would your reaction be different? The seed capital unchanged. The index fund mandate unchanged. The fee cap unchanged. The children unchanged.

Be honest!

And if it’s any consolation, naming programs after politicians has precedent. Roth IRAs and Pell Grants are named after the senators, William Roth and Claiborne Pell, that championed their creation. The tradition is long-standing, even if the optics here feel engineered to provoke.

At first I had the same reaction. I have been writing for months about the gulf between earners and owners. I have argued that capitalism becomes fragile when too many people are excluded from its rewards. I have criticized leaders who prefer symbolism over structural action.

Now structural action is here. It arrives from a president I abhor, wrapped in branding that feels designed to antagonize.

That creates a simple fork: dismiss a policy I support because of the sponsor, or take the win.

A Billionaire’s Patch

Still, the federal structure of Trump Accounts is flawed. The seed capital is indiscriminate. Families with significant wealth receive the same deposit as families living paycheck to paycheck. Contribution limits favor households with discretionary income, and the largest upside accrues to those already positioned to save.

Critics have highlighted this problem. They are correct. The policy does not address housing costs, healthcare, wage stagnation, or student debt. Those forces define the financial reality of ordinary families.

This program aims at something narrower yet still meaningful. It plants ownership early enough that young people begin adulthood with exposure to a compounding asset. It is a cultural intervention, in a way, rather than a total remedy.

Children in ZIP codes with median family income below $150,000 receive an additional $250. Twenty-five million kids under age ten qualify. Where Congress declined to apply means testing, private philanthropy applied it instead.

I do not love the precedent. A healthy democracy should not rely on wealthy benefactors to repair legislative design in real time. But perfect is not on the menu.

Sitting with Discomfort

The branding may be nauseating. The optics of billionaire involvement are suspicious. The timing feels theatrical. All of that can be true.

But this is also true: millions of children will soon own appreciating assets. They will watch balances grow through their childhood. They will understand that in a capitalist society, ownership shapes the arc of a life.

This program will not close the divides created by housing markets or medical expenses or stagnant wages. It cannot. Those forces require different policy tools. What this program can do is shift how young people relate to the machine that generates American wealth.

The idea Booker advanced and Democrats failed to enact is now law. The label may irritate and the sponsor may offend, but children will not care. They will pay attention to the number in the account when they turn eighteen and the possibilities that number creates.

Your grandchildren will inherit accounts created by this policy. They will grow up as owners. With luck, they will learn to navigate markets with confidence. Some may even defend a system that often failed their parents because they will finally have a foothold in it.

If that progress requires tolerating an unpleasant name, the trade feels acceptable.

Up and to the right.